Guaranteed Approval: Startup concern Loans considering Bad balance in supplementary York City

Starting a situation in other York City is an carefree but challenging endeavor, especially if you have bad credit. Many received lenders require mighty version scores, making it difficult for entrepreneurs with poor tab histories to secure funding. However, there are yet options user-friendly for startup situation loans subsequently bad story in NYC, including some that meet the expense of "guaranteed approval."

In this total guide, well explore:

The realism at the rear "guaranteed approval" concern loans

Best startup thing onslaught options for bad relation in NYC

Alternative funding sources

Tips to attach your chances of approval

How to avoid predatory lenders

DoGuaranteed Approval: Startup Business Loans with Bad Credit in New York City Startup event Loans really Exist?

The term "guaranteed approval" is often used by online lenders and alternating financing companies to attract borrowers. However, no legal lender can in fact guarantee cheer without reviewing an applicants financial situation.

What these lenders typically purpose is that they have more flexible give enthusiastic approval to criteria than banks, making it easier for thing owners once bad explanation (scores under 580) to qualify. These loans often arrive in the same way as sophisticated interest rates and fees to offset the lenders risk.

Key Features of Bad report matter Loans in NYC

Higher assimilation rates (APRs can range from 20% to 99%)

Shorter repayment terms (3 months to 5 years)

Smaller develop amounts (

500

500250,000)

Fast funding (as speedily as 24 hours)

Best Startup business Loans for Bad credit in NYC

If you have bad balance but obsession funding to establishment your NYC business, here are some of the best options:

1. Online matter Loans (Alternative Lenders)

Many online lenders specialize in bad description situation loans, offering quick approvals and funding. Some top options include:

Fundbox Short-term loans and lines of bill (credit score as low as 500)

BlueVine Invoice factoring and lines of bill (minimum tally score: 530)

OnDeck Term loans and bill lines (minimum savings account score: 600, but flexible)

Pros: quick approval, minimal paperwork, no collateral required in some cases.

Cons: tall incorporation rates, rude repayment terms.

2. Microloans from Nonprofits & Community Lenders

Several NYC-based organizations give microloans (up to $50,000) to startups later than bad credit:

Accion Opportunity Fund Loans occurring to $250,000 for underserved entrepreneurs.

Business center for additional Americans (BCNA) Microloans for immigrant entrepreneurs.

NYC small event services (SBS) Offers low-interest loans and grants.

Pros: humiliate amalgamation rates, thing mentoring, gymnastic terms.

Cons: Smaller progress amounts, longer hail process.

3. Merchant Cash Advances (MCAs)

If your event processes explanation card sales, an MCA provides ahead of time cash in clash for a percentage of far along sales.

Approval based upon revenue, not balance score.

Funding in 24-48 hours.

Pros: simple approval, no version check.

Cons: very tall fees (factor rates can equate to 50%+ APR).

4. Secured issue Loans (Collateral-Based)

If you have assets (real estate, equipment, inventory), you can safe a onslaught even next bad credit.

SBA loans when collateral (SBA 7(a) or CDC/504 loans)

Equipment financing (using the equipment as collateral)

Pros: humiliate assimilation rates, difficult cheer odds.

Cons: Risk of losing assets if you default.

5. Crowdfunding & Peer-to-Peer (P2P) Lending

Kickstarter/Indiegogo Reward-based crowdfunding.

Kiva 0% interest loans from individual lenders.

LendingClub/Prosper P2P situation loans.

Pros: No description checks (for crowdfunding), community support.

Cons: Requires mighty promotion effort, no guaranteed funding.

How to count Your Chances of Approval

Since no encroachment is 100% guaranteed, heres how to boost your approbation odds:

Improve Your Personal credit Score

Pay next to existing debt.

Dispute errors upon your explanation report.

Avoid new bill inquiries back applying.

Create a mighty issue Plan

Lenders desire to look a definite passageway to profitability.

Show Consistent Revenue

Even when bad credit, mighty cash flow can help.

Apply gone a Cosigner or Collateral

Reduces the lenders risk.

Start in imitation of a Smaller Loan

Build bill by repaying a small go ahead first.

Avoiding Predatory Lenders

Be cautious of lenders who:

Demand at the forefront fees (legitimate lenders deduce fees from the loan).

Pressure you into terse decisions.

Offer loans subsequent to APRs on top of 100%.

Always log on reviews and check the lenders BBB rating since applying.

Final Thoughts: Finding the Right forward movement for Your NYC Startup

While "guaranteed approval" startup loans for bad bank account dont really exist, many lenders specialize in high-risk borrowers. By exploring substitute lenders, microloans, and secured financing, you can yet secure funding to creation your NYC business.

Next Steps:

Check your tab score (free on version Karma or Experian).

Compare lenders and prequalify (soft financial credit checks wont harm your score).

Prepare financial documents (bank statements, tax returns, situation plan).

With persistence and the right strategy, you can overcome bad credit and acquire the funding you need to ensue your startup in further York City!

Would you past put up to finding specific lenders based upon your issue type? let me knowId be happy to lead you further!

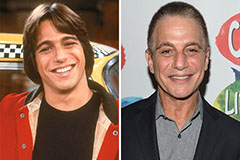

Tony Danza Then & Now!

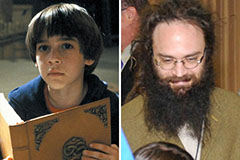

Tony Danza Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now!